How many times have you taken money from the ATM only to realize a couple of days later that it is gone? There is always situation where you have difficulties to remember how exactly you spent the money, and often times this money is wasted on unnecessary purchases. Many people have no idea exactly where or how they spend a good portion of their money. One tool to help people manage their expenses is a personal budget. In order to reverse this trend, people need to become more responsible with their spending patterns. Because people tends to spend their money as soon as they get paid and think about saving it several days before getting paid again.

We saw any marts, restaurants, stores are more quiet on those weeks comparing with previous weeks. That is the reason people or family are sort of money every last week in every month.

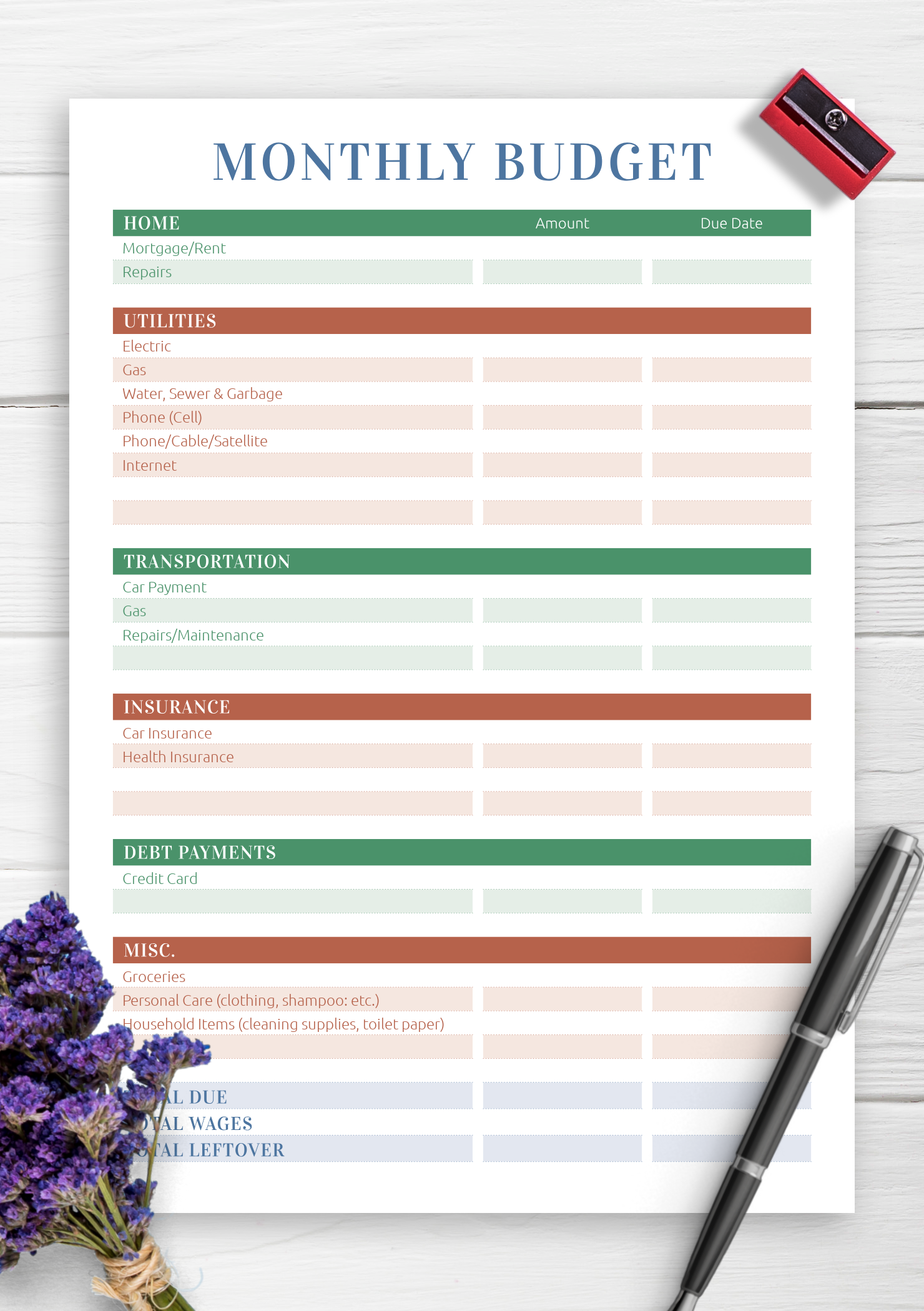

SIMPLE PERSONAL BUDGET TEMPLATE HOW TO

Some people don’t know how to make it, some others don’t have intention on limiting their expenses. There are very few people who understand the needs of budgeting their expenses. A good budget will consider all the factors above and still have some savings on income by the end of month. Flexible expenses are expenses that related with variable amount of money that has to be spent based on people behavior. For example: mortgage, school fee, cable TV etc where the money being spent is fixed per month. Fixed expenses are usually obligation expenses. The income must cover all expenses, fixed and flexible expenses, where fixed expenses become top priority to be fulfilled every month.

The limitation is usually based on income being received. The most common period used as a reference is one month period. What is a personal budget definition? Refer to several internet sites, a personal budget is a financial plan that limits the amount of money that will be spent on any expenses category in any period of time.

0 kommentar(er)

0 kommentar(er)